Part 3 Window of Opportunity Renting vs Owning

Thanks for checking back in for the next installment of the Window of Opportunity.

Choosing between renting and buying a home is a big decision and there are pros and cons to both. Here's a great pros and cons comparison list you can use.

RENTING

Pros

- Renting may be best if you’re staying in a place short term.

- Low to no repair and maintenance costs.

- You can choose to rent in an area that’s close to your work, your kids’ school or shops and restaurants you like.

- Renters insurance is relatively inexpensive.

Cons

- Yearly rent increases are normal. The last few years in Columbus this has been a 20-27% yearly increase.

- No equity, no ownership.

- No financial gains. The landlord gets your money.

- Extra fees/charges due to pets, maintenance and security deposits, which are rarely ever returned to renters in full.

- Not tax deductible. Unlike mortgage interest, rent isn’t a tax-deductible expense; rent payments won’t lower your taxes.

BUYING

Pros

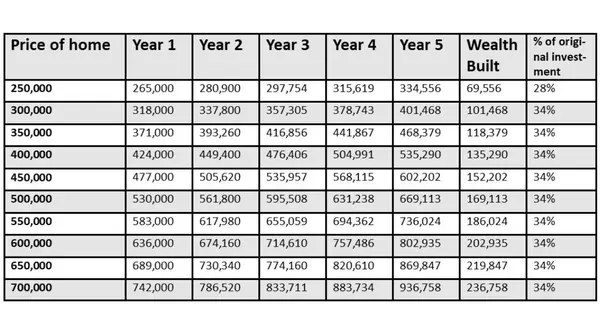

- You own it and gain equity. Every mortgage payment you make contributes to building your equity. Even if you sell your home before it’s paid off, you can cash out your equity and use it as a down payment on the next home.

- Investment growth. Here in Central Ohio the average home value goes up 6% every year.

- Tax deduction: Mortgage interest you pay decreases your income tax liability and can help you save in taxes.

- Pets allowed!

- Paint it, decorate it, fix it, change it - it’s yours.

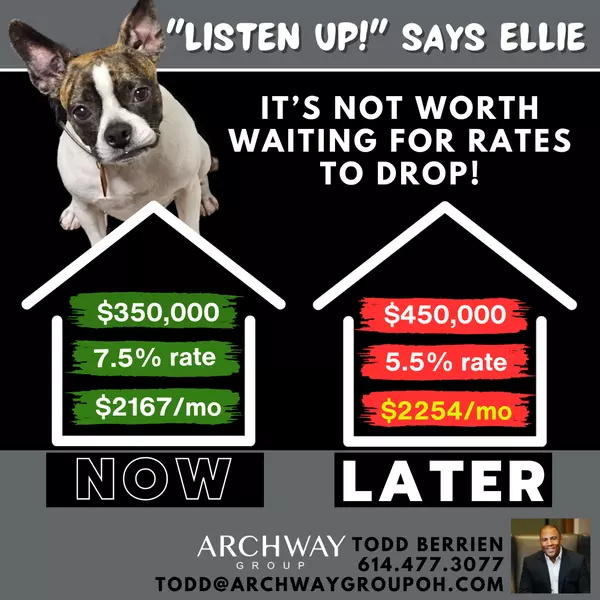

- Fixed payments. With a fixed-rate mortgage, your monthly payments won’t change during the course of the loan. If interest rates rise, you’ll still be locked in to your initial rate.

- Payments build credit: Lenders report payments to credit bureaus, timely mortgage payments improve credit scores.

Cons

- Upfront costs: You’ll need some cash to provide a down payment for the mortgage. However, some government-insured home loans are available with zero downpayment. Call us and we can get you connected to a lender that will find the best rate for your situation.

- Closing costs, which can account for 2% to 5% of the home’s sale price. These are usually added to the cost of the loan.

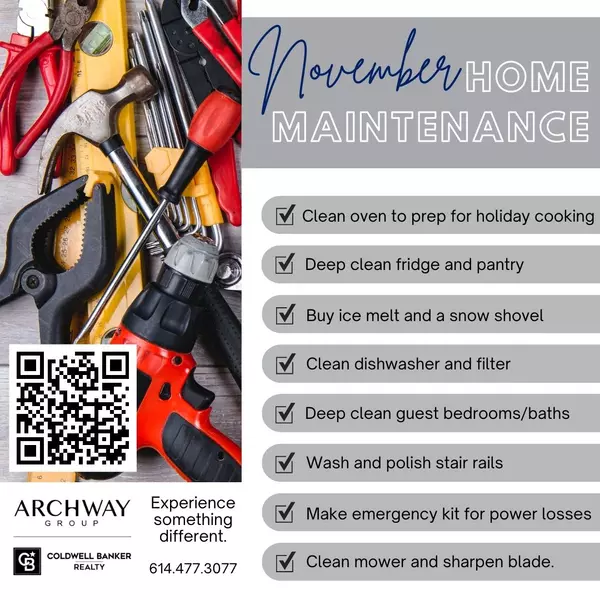

- Responsibility for repairs falls on the homeowner. Getting a Home Warranty may help with this.

- Additional monthly/yearly expenses like HOA fees, taxes, insurance, etc.

Of course, we think buying a home is better than renting. That's our business. But we're telling you this information so that you can see for yourself what the benefits are. Even if you're at the "Just Thinking About Buying Stage," do yourself a favor. Call us at 614.764.2551. We can help you understand the process, connect you to lenders and help you through the entire transaction when you are ready and able.

Read on for Part 4 Demographics, Inventory and Competition (it's pretty eye-opening).

Categories

Recent Posts

GET MORE INFORMATION

Owner | License ID: 2013002395