Part 1 The Window of Opportunity is NOW

Welcome to Part 1 of my blog series about this unique buying time in the Central Ohio area. I hope you find it helpful. Check in on Tuesdays and Thursdays for the next blog in this series.

Today we are going to talk about how Central Ohio is at a tipping point in the housing industry. We believe this fall and winter will be a “Buyers’ Window of Opportunity” as competition will decrease and home affordability will be within reach. Here's why:

- Mortgage rates are at or below the 50-year average.

- Inventory is higher than its been for the last 3 years.

- There are fewer buyers in the fall.

Let's look at Mortage Rates.

Those record-low 2-3% aren't returning any time soon and likely they may never happen again, according to top economists, Realtor.com, Fannie Mae, the National Association of Realtors, and the Mortgage Bankers Association. These experts expect mortgage rates to be slightly lower by the end of 2023. Predictions range from 6% to 6.7% on average.

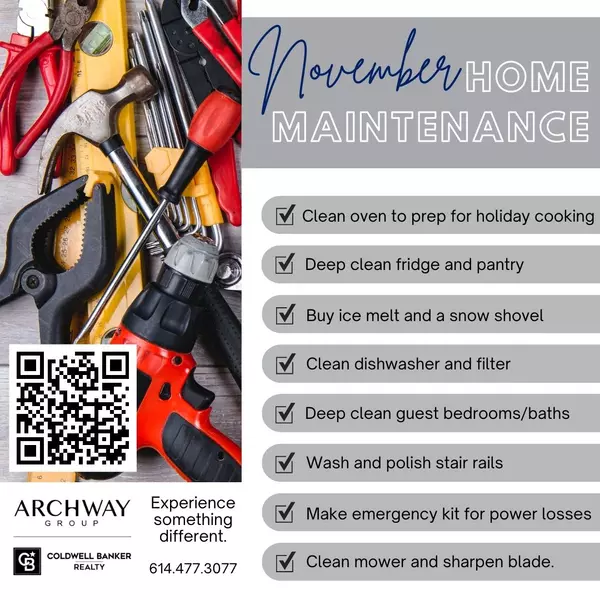

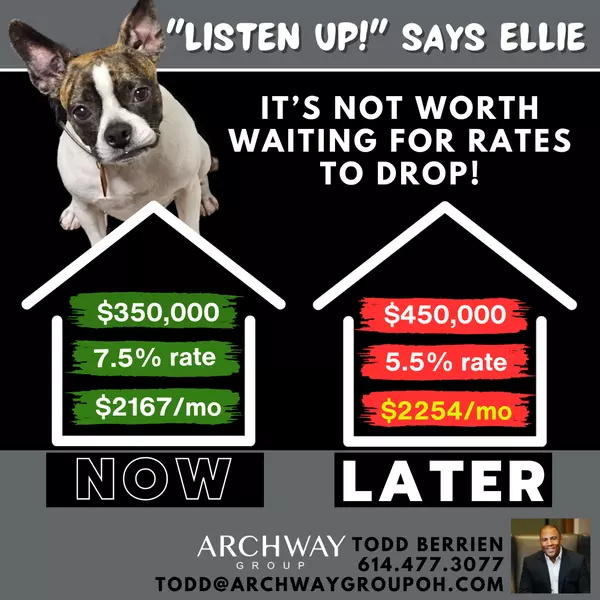

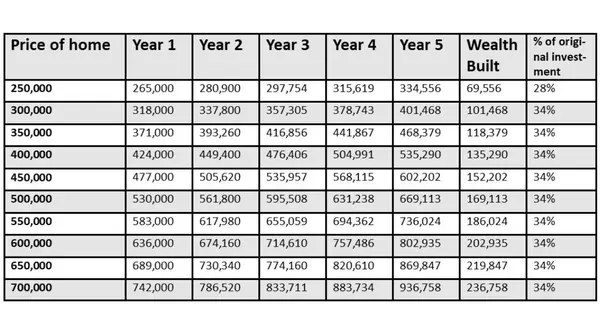

Here's the takeaway - our current rates are NORMAL. Since 1971, the average mortgage rate falls into the 7-8% zone. Check out the chart below.

A slightly higher rate might not be financially detrimental when purchasing a home - especially if it means you can get a home at a good price. A 7.23% rate (9/13/23 average) on a 30-year $400,000 loan creates a $2,723 monthly payment. At 6.7%, this monthly payment falls to $2,581, just a $142 difference. If you can purchase a home now, while there’s less competition, you can always refinance when rates drop.In fact, some lenders are even offering reduced costs to refinance if rates drop.

Rates are within the norm. Start your buying journey. Call us and we will help you find the best lender for your situation!

Categories

Recent Posts

GET MORE INFORMATION

Owner | License ID: 2013002395