Part 2 The Wealth-building Benefit of Homeownership.

Thanks for coming back for part two in the Window of Opportunity homeownership blog. Today we're going to be discussing the wealth-building benefit of homeownership.

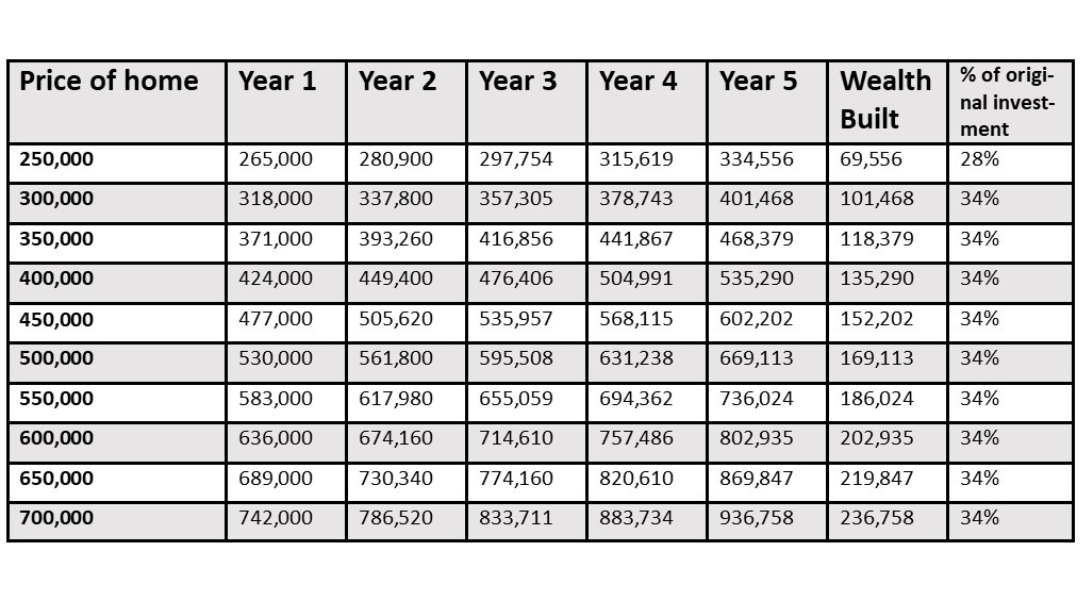

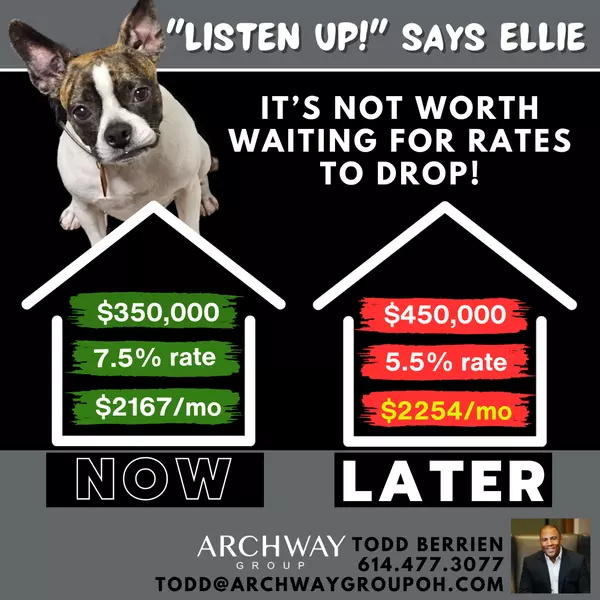

Buying a home is the best wealth-building investment you can make. Let’s say you buy a $400,000 home and put down 10% ($40K). The national average rate that housing prices go up each year is at least 2%. (Here in Columbus it’s significantly higher 6%+). On a $400,000 home, this would be $8,000 return PER YEAR – which means on average you’re getting a 20% return on your original $40K investment. Home prices only go up - even if there's a recession. Prices drop a little during a recession (good for buyers), but recover quickly and regain value (great for buyers). Since 1960 there have been eight recessions and after each one, home prices rebounded and increased.

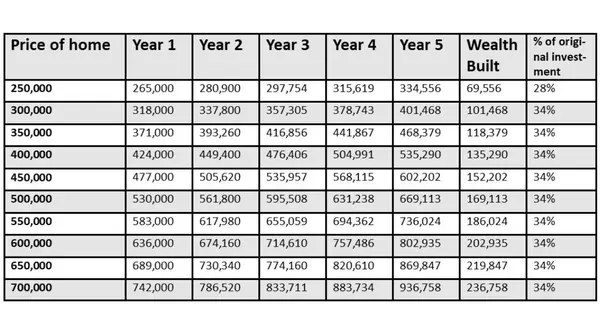

Take a look at the chart below. You can clearly see how your money grows.

The other financial bonus to owning a home is the mortgage interest deduction tax shelter, if you itemize. On the same $400,000 house, where the loan is $360,000, a 6% principal and interest rate is $2158. Assuming you have followed the payment plan and paid your loan, you would be paying $21,479 in mortgage interest. If you are in the typical 30% tax bracket and if you itemize on your taxes, you can actually write off 30% of the value of the interest – about $6443. That’s almost an 18% return.

I hope you find this helpful. Be sure to share this information with anyone who might find it beneficial. And call us if you need to discuss your home search 614.764.2551. Check back later for Part 3 - Renting vs Owning.

Categories

Recent Posts

GET MORE INFORMATION

Owner | License ID: 2013002395